In a sweeping announcement in early June 2025, former U.S. President Donald Trump declared a doubling of steel and aluminum tariff—from 25% to 50%—during a rally in Pittsburgh. The move, framed as a measure to protect the domestic steel industry and reduce reliance on foreign imports, has sent shockwaves through the manufacturing sector and indirectly impacts the agricultural machinery industry.

But beyond politics, one thing is clear: global supply chains just got more expensive and more uncertain.

Nowhere is this impact more direct than in agricultural machinery—an industry that relies heavily on structural steel, aluminum alloy parts, and precision-cast components. Whether you’re a dealer in Europe, a grain cooperative in the Midwest, or an importer in the Middle East, this policy shift demands a reevaluation of your procurement strategy.

Contents

What This Means for the Global Agricultural Machinery Supply Chain

1. Cost Surges Across the Board

With 50% tariffs on core raw materials, U.S.-based machinery manufacturers are facing skyrocketing input costs. This will inevitably translate into higher final prices on tractors, harvesters, and irrigation equipment—regardless of whether the product is made entirely in the U.S.

For importers, especially those sourcing from North America or heavily U.S.-dependent brands, landed costs are expected to increase by 15–30% over the next 6–12 months.

2. Supply Chain Instability

The steel tariff escalation adds pressure to an already volatile logistics network. OEMs that rely on international steel supply chains (especially Japan, Canada, and Mexico) must now deal with renegotiated contracts, stock delays, or cancellations.

Delays in part availability—such as gear casings, chassis rails, or axle housings—can ripple into multi-month lead times for whole machine deliveries.

3. Strategic Repositioning of Buyers

Many European and Southeast Asian buyers are shifting toward “value-engineered” suppliers outside the tariff scope. Cost-effective manufacturing hubs in China, Turkey, India, and Vietnam are being re-evaluated—not just for price, but for agility and adaptability.

MINNUO, as one of China’s established agricultural machinery brands, is fast becoming a resilient alternative.

Why MINNUO Is the Smart Choice in a High-Tariff World

MINNUO has quietly built its reputation on consistent product quality, modular customization, and rapid response to geopolitical and macroeconomic shocks.

Value without Compromise

Unlike many “low-cost” suppliers, MINNUO uses industry-grade steel (certified per ISO9001/CE/ROHS standards), but sources it via flexible, multi-region channels. This means no single tariff policy can drastically destabilize their pricing.

Example: While U.S. tariffs hit Japan and Mexico hardest, MINNUO sources chassis-grade steel from certified Tier 1 suppliers in both domestic and ASEAN countries, ensuring price stability.

Full Range Product Portfolio

From compact tractors (25hp–50hp) to 180hp crawler models, and from rice transplanters to grain seeders, MINNUO offers over 120 product lines, many of which are already adapted for:

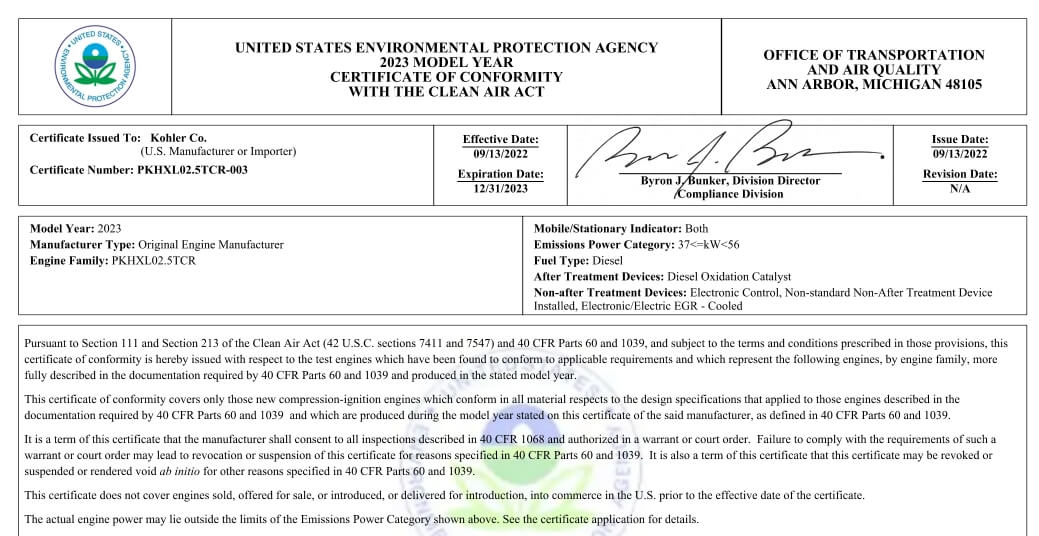

EPA-compliant emissions (Tier III/IV)

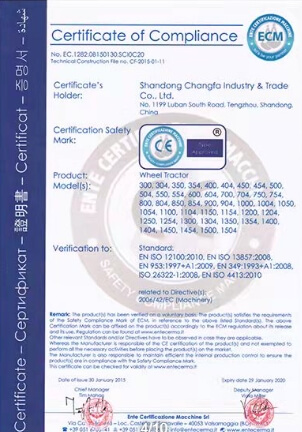

European CE conformity

Hot/dry/wet weather regions (custom tires, radiators, filters, etc.)

✅ Regionalized Customization

Every export order is matched to local climate, terrain, and regulations:

Middle East: sand-filtered engines, reinforced rubber seals

North America: wide-row planters, cold-start diesel preheaters

Europe: narrow-track vineyard tractors with E-mark lighting

Market Advice for Global Buyers and Distributors

For U.S. Buyers

If you rely on imported or assembled-in-USA equipment with steel-intensive parts, factor in a 6–9 month cost correction.

Diversify supplier bases before fall harvest purchasing cycles begin.

Ask about “non-U.S. steel source” statements for tariff-free re-export.

For European Importers

Focus on landed cost per field hour, not per unit. MINNUO’s fuel-efficient diesel platforms offer 15% lower LCO per season than some U.S. brands, even before tariffs.

For Middle Eastern Buyers

Avoid resellers overly dependent on U.S.-made implements. Opt for brands with high spare part availability and factory customization—such as MINNUO’s irrigation-ready series and dust-proofing kits.

For Latin American Distributors

Look for brands like MINNUO that can pre-stock common wear parts (e.g. disc blades, bearings, belts) locally or via bonded warehousing.

Real Customer Cases

France | Cooperative Agriculteurs du Rhône

“We switched to MINNUO last year when U.S. prices became unpredictable. Their 90hp tractor handles vineyard gradients well, and with 3x fewer maintenance needs.”

Saudi Arabia | Khalid Agro Equipments

“The MINNUO sand-sealed combine has lasted through two harvests with zero electrical failures. We now import full containers every quarter.”

Philippines | Luzon Rice Producers Group

“The paddy-type models from MINNUO outperform others in our wetland zones—and cost 20% less than similar models from the U.S.”

❓ Frequently Asked Questions (FAQ)

Q1: Does MINNUO use tariff-affected steel?

A: No. MINNUO uses regionally diversified raw material supply, bypassing U.S.-specific tariffs while maintaining quality.

Q2: Can MINNUO machines comply with EU or U.S. safety and emissions standards?

A: Yes. Our factory supports CE/ISO/EPA Tier 3/4 exports, and we regularly fulfill orders to Germany, Spain, and Canada.

Q3: How long is the lead time for custom orders?

A: Standard configurations ship in 15–25 days. Fully customized units may take 35–40 days with sea freight.

Q4: What support does MINNUO provide for post-sale service?

A: We offer spare parts supply plans, exploded view manuals, video maintenance tutorials, and remote video troubleshooting.

Q5: Do you offer pricing in Euros or USD?

A: Yes, we quote in both USD and EUR, with flexible incoterms: FOB, CFR, CIF, DDP on request.

Final Thought

In the age of economic nationalism, global buyers must think beyond brands and focus on the supply chain resilience and operational cost-effectiveness.

MINNUO is more than a low-cost option—it’s a strategic hedge against tariff turbulence. Whether you’re looking to stabilize costs, reduce procurement risk, or expand your machine fleet without breaking the bank, MINNUO is ready to deliver.

Contact us today at https://minnuoagro.com to get a customized quote for your country and climate.