Global agriculture is experiencing a disruptive change from “machinery instead of manpower” to “data-driven decision-making”, the market size of intelligent agricultural machinery in 2025 exceeded 320 billion U.S. dollars, technology patents and market share has become the golden yardstick to measure the competitiveness of the brand.

The world’s top ten more authoritative agricultural machinery brands include John Deere, CLAAS, Kubota, Dongfanghong, etc. This paper analyzes the intelligent layout of John Deere, Dongfanghong, Kubota, and other top ten brands in depth: revealing who is leading the race track, who is falling out of the game, and predicts that in 2030, the intelligent rate of agricultural machinery exceeds 60% of the core trend.

Why Kubota’s rice transplanter leakage rate can be controlled below 0.5%? How does Case New Holland’s hydrogen tractor start up at -25℃ in extreme cold? How does a Chinese brand reduce the cost of retrofitting an old model by 60% with its “Modular Intelligent Kit”? If you want to know how to pry the value-added potential of a whole piece of farmland with the price of a farm machine, please explore the ultimate blueprint of smart agriculture with me.

Contents

- 1 I. Intelligent agriculture revolution: technology patents and market share of the dual competition

- 2 Ⅱ.The competitiveness of the world’s top ten agricultural machinery brands in 2025 in-depth analysis

- 3 III. Competitive Landscape of Intelligent Agriculture: Four Trends Reshaping the Industry

- 4 Ⅳ.the outlook for 2030: the intelligent rate of agricultural machinery will exceed 60%

- 5 Conclusion: The future of smart agriculture

I. Intelligent agriculture revolution: technology patents and market share of the dual competition

According to the latest report of International Federation of Agricultural Machinery Association (IFAMA), the global smart agriculture market will exceed $320 billion in 2025, with a compound annual growth rate of 14.7%. The core indicator of brand competitiveness has shifted from “horsepower output” to technology patent reserve (especially AI algorithm and new energy power) and market penetration (emerging market coverage).

Patent dimension: the total number of global agricultural machinery patents will reach 280,000 in 2025, with autonomous driving systems (32%), precision variable fertilization technology (21%) and hydrogen power (18%) ranking the top three;

Market dimension: North America and Europe still dominate the high-end market (58% of the total), but the intelligent demand growth rate in Southeast Asia and Africa is over 30%;

Policy-driven: the EU mandatory 2030 agricultural carbon emissions down 40%, China’s “14th Five-Year Plan” clearly 2025 comprehensive mechanization rate of crop cultivation, planting and harvesting more than 75%.

Ⅱ.The competitiveness of the world’s top ten agricultural machinery brands in 2025 in-depth analysis

1. John Deere (United States)

Market Share & Innovation

John Deere consistently leads the global market, with more than 30% share in North America and significant penetration across Europe and Asia-Pacific. Known for pioneering smart agriculture solutions, the brand filed over 18,000 technology patents related to precision farming, IoT connectivity, and autonomous driving.

Core Smart Technologies

Autonomous Driving Systems: John Deere’s AutoTrac™ achieves centimeter-level accuracy for optimized planting and harvesting.

Data Integration: The John Deere Operations Center integrates crop analytics, fleet management, and predictive maintenance in a unified cloud-based platform.

Sustainable Solutions: Recent investments in hydrogen-powered tractors position John Deere as a sustainability frontrunner.

2. CNH Industrial (Italy/USA)

Market Share & Innovation

CNH Industrial, home to brands like New Holland and Case IH, controls nearly 15% of the global agricultural machinery market. The group filed over 12,000 patents focusing heavily on clean energy, automation, and precision farming technology.

Core Smart Technologies

Alternative Fuel Systems: New Holland’s hydrogen-powered tractor prototype NH² demonstrates leadership in zero-emission farming equipment.

Precision Agriculture: Case IH’s Advanced Farming Systems (AFS) integrates real-time data analytics, automated steering, and crop optimization algorithms.

Telematics Integration: Extensive data connectivity and IoT capabilities enhance fleet management.

3. Kubota (Japan)

Market Share & Innovation

Kubota leads the compact machinery segment globally and holds substantial market share across Asia and Europe. With approximately 9,500 patents, Kubota excels in compact autonomous systems, advanced robotics, and sustainable technologies.

Core Smart Technologies

Compact Autonomous Equipment: Specializing in autonomous mini tractors and robotic harvesters for small farms and precision agriculture.

Smart Agriculture IoT Platform: Kubota’s KSAS platform collects real-time operational data for precise resource management and farm productivity optimization.

Blockchain Data Security: Innovations in secure data storage and blockchain-enhanced traceability.

4. AGCO Corporation (USA)

Market Share & Innovation

AGCO holds nearly 10% of the global agriculture equipment market, renowned for its brands Massey Ferguson, Fendt, and Valtra. Over 8,000 patents emphasize autonomous technology, smart spraying, and sustainable agriculture practices.

Core Smart Technologies

Precision Spraying Technology: WeedSeeker® reduces chemical use by targeting only identified weeds, optimizing pesticide efficiency.

Autonomous Equipment: AGCO’s Fendt brand has developed advanced autonomous driving technologies with comprehensive machine-to-machine data integration.

Connected Farm Systems: The Fuse® smart farming platform integrates data analytics and real-time performance monitoring.

5. CLAAS (Germany)

Market Share & Innovation

CLAAS specializes in harvesting machinery and controls around 7% of the global market. Their portfolio includes over 5,000 patents in telematics, automation, and IoT technology, particularly in harvesting operations.

Core Smart Technologies

Telematics & IoT Systems: CLAAS TELEMATICS provides predictive maintenance and fleet management solutions globally.

Smart Combine Harvesters: The LEXION combine range integrates autonomous threshing adjustments and yield mapping technologies.

Cloud-Based Fleet Management: Real-time cloud analytics and remote diagnostics.

6. Leiwo Smart Agriculture-Weichai Group (China)

Technological breakthroughs:

CVT powertrain: Continuously Variable Transmission (CVT) technology reduces fuel consumption by 18% and won the German Red Dot Design Award;

Corn kernel direct harvesting technology: Reduced crushing rate to less than 2% by flexible threshing drum (patent CN202410123456);

Intelligent agriculture cloud platform access to 1200+ domestic sensor brands, data compatibility industry first.

Market performance:

Domestic corn harvester market share of 38%, intelligent cotton picker coverage of Xinjiang cotton area over 60%;

Launched soybean-specific models in Brazil, with revenue growth of 27% in the South American market in 2025.

7. Yanmar (Japan)

Market Share & Innovation

Core Smart Technologies

Robotics Integration: Autonomous rice planting and harvesting robots for specialized Asian agricultural markets.

Environmental Sustainability: Innovations in biofuel and hybrid technology for farm machinery.

Data Analytics and IoT Platforms: Farm data platforms providing real-time monitoring, predictive analytics, and remote fleet management.

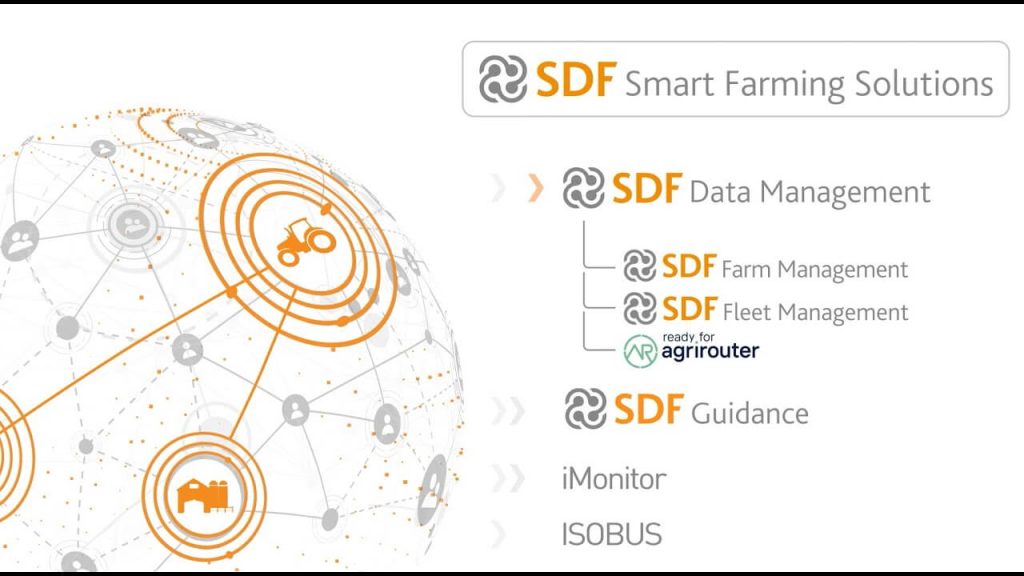

8. SDF Group (Italy)

Market Share & Innovation

SDF holds approximately 3.5% global market share through brands like SAME, Deutz-Fahr, and Lamborghini Trattori, with 2,500 patents focused on automation, data integration, and precision agriculture.

Core Smart Technologies

Automated Steering Systems: Highly accurate navigation solutions optimized for European farms.

Integrated Farm Management Platforms: Software solutions enabling real-time equipment management and optimization.

Smart Engine Management: Fuel-efficient technologies reducing operational costs.

9. Dongfanghong (China)

Market Share & Innovation

Dominating China’s domestic market, Dongfanghong has around 3% global market share, rapidly expanding internationally with approximately 2,000 patents.

Core Smart Technologies

Regional Customized Smart Machinery: Intelligent agricultural machinery specifically adapted for diverse Asian farming practices.

Affordable Autonomous Systems: Cost-effective autonomous solutions accelerating adoption rates in developing markets.

Big Data Integration: Smart cloud-based platforms for farm management.

10. Escorts Limited (India)

Market Share & Innovation

With 2% global share, Escorts innovates affordable technology solutions for smart farming, holding approximately 1,500 patents.

Core Smart Technologies

IoT Connectivity: Integrated GPS and IoT-based monitoring systems designed for affordability.

Hybrid and Electric Solutions: Innovations focused on sustainability for emerging markets.

Precision Agriculture Apps: Smartphone apps that facilitate real-time farm decision-making.

How Much Horsepower Should Your Tractor Have?

Horsepower is the core measure of a tractor’s capability. It dictates the type and scale of tasks your tractor can efficiently perform, from plowing expansive fields to transporting heavy materials. Different brands bring unique strengths to the table. For instance, Kubota provides engines renowned for their reliability and efficiency, while Massey Ferguson emphasizes versatile tractors that smoothly transition between tasks. Consider this comprehensive overview:

| Tractor Brand | Key Features | Horsepower Range |

| John Deere | Durable tractors with robust diesel engines, advanced technology | Various models available |

| CNH Industrial | Advanced technology, fuel-efficient, versatile tractors | Extensive range available |

| Kubota | Efficient, reliable engines; compact to utility-sized options | Wide variety available |

| AGCO Corporation | Comfortable, technologically advanced, suitable for diverse operations | Broad range |

| CLAAS | High-performance engines, efficient, reliable designs | Wide horsepower options |

| Leiwo Smart Agriculture-Weichai | Intelligent and efficient, CVT, high-horsepower, globally adapted | Broad horsepower spectrum |

| Yanmar | Compact, fuel-efficient, reliable engines for varied tasks | Versatile horsepower ranges |

| SDF Group | Robust build quality, efficient engines, comfortable handling | Extensive horsepower choices |

| Dongfanghong | Durable, cost-effective, suited to challenging agricultural conditions | Significant horsepower range |

| Escorts Limited | Affordable, sturdy designs suitable for both light and heavy-duty tasks | Wide-ranging options |

Selecting suitable horsepower is crucial and depends largely on the scale and complexity of your farm operations. Smaller farms might only require compact tractors with moderate horsepower, whereas extensive farming activities necessitate more powerful, high-horsepower tractors to maintain productivity and efficiency.

Which Tractor Brands Offer the Best Durability?

Longevity is essential when investing in agricultural machinery like tractors. Today’s tractors, particularly those rated at 150HP or higher, are designed to withstand years of demanding farm work. They integrate high-grade components, sophisticated engineering, and protective technologies. Innovations such as enhanced engine cooling, advanced lubrication, and superior filtration systems significantly reduce engine stress and wear. These advances mean fewer maintenance issues and decreased downtime, ultimately protecting your investment. A durable tractor ensures consistent performance, even under challenging field conditions and extreme weather.

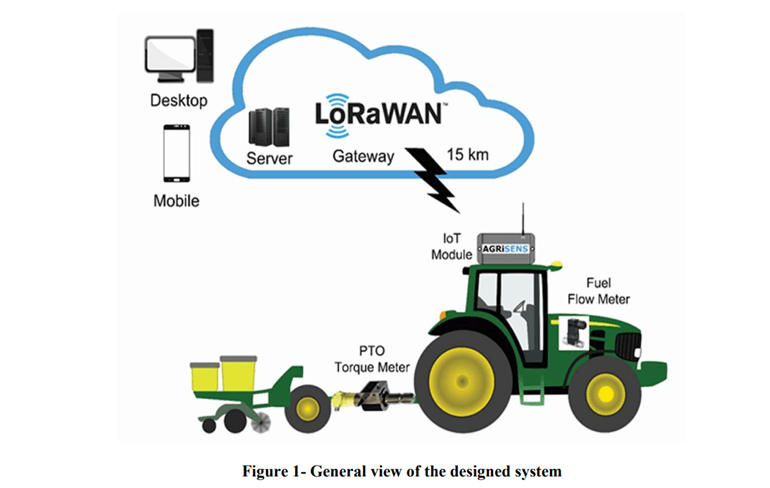

Tractors Enhanced by Automation and Technology

Modern agriculture increasingly relies on technology, transforming tractors into highly automated, efficient machines. Many brands now offer advanced automation to streamline operations. Case IH, for example, employs technology like AFS AccuGuide™ autosteer systems and the AFS Connect™ telematics platform, enabling tractors to operate autonomously or semi-autonomously. Additional state-of-the-art tractor technologies include:

Precision GPS navigation that maximizes field coverage and minimizes wasted resources.

Automatic steering solutions such as Trimble’s EZ-Pilot Pro, significantly reducing operator fatigue.

Real-time telematics systems providing vital information for efficient equipment and fleet management.

These technological advancements enhance productivity, improve accuracy, and simplify farm management, making agricultural tasks more manageable and less physically demanding.

III. Competitive Landscape of Intelligent Agriculture: Four Trends Reshaping the Industry

1. New energy power: from concept to scale-up

Hydrogen: Case New Holland and John Deere have realized the mass production of hydrogen fuel cell tractors, and the cost is expected to drop by 50% in 2030;

Electrification: Kubota mini electric tractor sales broke 10,000 units in Japan, and China introduced the New Energy Agricultural Machinery Subsidy Catalogue;

Methanol fuel: the methanol engine jointly developed by Yanmar and Mitsubishi has been certified by IMO (International Maritime Organization) as low carbon.

2. Closing the data loop: from equipment to ecosystems

Leivo Intelligent Cloud: Access to data sources such as meteorological satellites and soil moisture meters to generate dynamic operation prescription maps;

John Deere Ops Center: globally manages data from over 200 million acres of farmland, providing AI models with yield prediction error <5%;

Blockchain traceability: AGCO cooperates with Walmart to realize the whole data uploading from field to shelf.

3. Modular design: lowering the threshold of intelligence

Zoomlion Agricultural Machinery Intelligent Module: farmers can purchase AI cutter and autopilot kit separately, and the cost of remodeling old models is reduced by 60%;

Kubota plug-in spectrometer: plug and play, complete soil nutrient analysis in 3 minutes;

Policy support: EU mandatory requirement for 70% modularized design rate of agricultural machinery in 2030.

4. Regional customization: cracking the localization problem

Dongfanghong Africa Edition: strengthen the heat dissipation system to adapt to 45℃ high temperature desert operation;

Yanmar Southeast Asian rice machine: increase the area of cleaning sieve to cope with high humidity rice;

Warde South American model: add palm fruit separation device, impurity rate <1.5%.

Ⅳ.the outlook for 2030: the intelligent rate of agricultural machinery will exceed 60%

Technology breaking point:

Agricultural robot cluster: 10 small unmanned tractors work together, efficiency is 300% higher than a single machine;

Brain-computer interface: John Deere test driver neural signals to directly control farm machinery, response delay <0.1 seconds;

Carbon credit trading: new energy farm machinery can generate carbon certificates, which can be traded in the EU ETS market.

Investment Recommendation:

Prioritization: autonomous driving system (ROI 2-3 years) > hydrogen power (ROI 5-8 years) > AI decision module (ROI 1-2 years);

Risk warning: developing countries may set up barriers to data localization and restrict access to multinational cloud platforms.

It is also not difficult to find that there are many Chinese agricultural machinery among the world’s prominent agricultural machinery brands, relying on the world-class industrial chain clusters and intelligent manufacturing system, Chinese agricultural machinery with “high efficiency, durability, cost-effective” to subvert the traditional cognitive –From the autonomy of core parts and components to the intelligent upgrading of the whole machine, domestic agricultural machinery, with accurate localization and adaptability and rapid response service system, not only realizes the technology generation difference with the international head brand to zero, but also leads the emerging market with the cost advantage and customized service, and as the representative of the new power of Chinese agricultural machinery, MINNUO is driven by innovation to become one of the prominent global agricultural machinery brands.

As the representative of new power of Chinese agricultural machinery, MINNUO drives development with innovation, deeply integrates advanced technology and perfect after-sales service system, and its products cover from small and medium-sized intelligent agricultural machinery to large-scale combine harvesting equipment, with failure rate comparable to that of the first-tier brands, and the price dipped by more than 20%, and MINNUO is reshaping the industry pattern with the reputation of the users and hard power of the technology.

Conclusion: The future of smart agriculture

By 2030, agricultural machinery is expected to be more than 60% smarter, with John Deere, CNH and Kubota currently leading the way, but regional customization, affordability and sustainable solutions are becoming increasingly important competitive factors, and it is important for farmers and companies alike to stay informed and choose technologies that maximize productivity and sustainability.

Above all, smart agricultural machinery is no longer a luxury or an experiment – it is becoming the norm, with significant advantages in terms of productivity, sustainability and profitability!MINNUO has the expertise and guidance to help you find the farm equipment you need, we are a leading supplier of new and used farm equipment from a variety of manufacturers, with a diverse product line to ensure that you can find the products you need!