In April of that year, following the Trump administration’s announcement of a 34% retaliatory tariff on Chinese goods, China swiftly responded with countermeasures, making soybeans one of the core areas of the trade friction. The U.S. used soybeans as a political bargaining chip, demanding that China resume purchasing American soybeans as a prerequisite for considering tariff adjustments. This politicization of economic and trade issues caused China–U.S. soybean trade to come to a halt — according to data from China’s General Administration of Customs, U.S. soybean exports to China in September dropped from 1.7 million tons in the same period last year to zero, marking the first “zero export” since November 2018. More importantly, China has, through years of strategic planning, built a diversified import system of “Brazil + Argentina + Russia,” with Brazil Soybean exports now playing a dominant role in meeting China’s growing demand and significantly reducing its dependence on American supply. Even with the suspension of U.S. soybean purchases, China’s total soybean imports from January to September still increased by 5.3%, clearly indicating a trend of global supply chain restructuring.

This reshaping of trade patterns has paved the way for opportunities for Brazilian soybean growers. We can analyze this from three “economic accounts”: China’s annual demand of over 110 million tons and more than 71% import share create a “demand certainty” for Brazilian soybeans; the profitability compared to corn and other crops highlights the “cost-effectiveness advantage” of growing soybeans; and the efficiency bottlenecks under the 121 million-acre expansion target create an urgent need for adapted agricultural machinery, ultimately pointing to solutions that balance cost-effectiveness with localized adaptability.

For farm owners in Mato Grosso or family farmers in Rio Grande do Sul, this is far from a random market fluctuation — it is an economic opportunity worth careful calculation.

Contents

- 1 First Account: How Strong Is the “Demand Certainty” from the Chinese Market?

- 2 Second Account: Is the “cost-effectiveness” of Brazil Soybean high?

- 3 Third Account: Brazil Soybean after Expansion, How Can “Production Efficiency” Be Ensured?

- 4 Final Choice: What Kind of Agricultural Machinery Can Match the Demand?

First Account: How Strong Is the “Demand Certainty” from the Chinese Market?

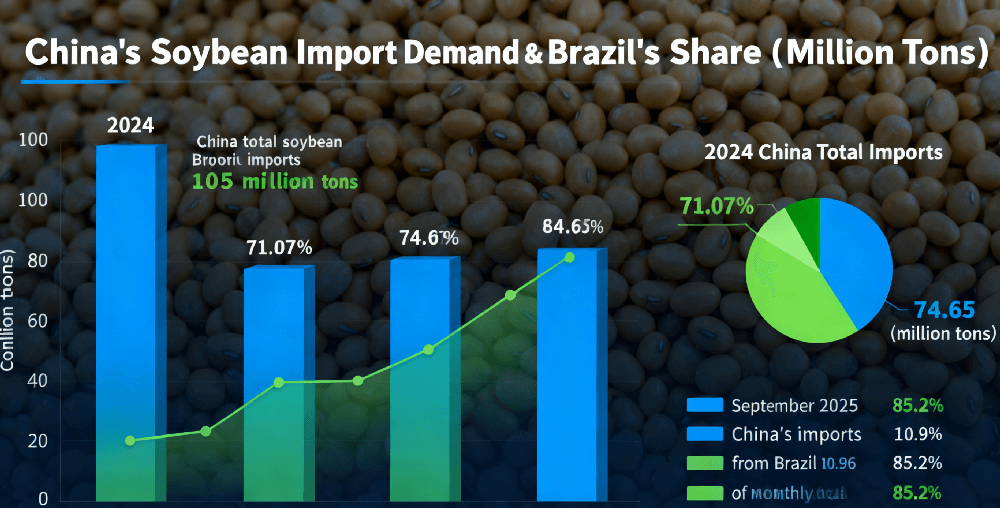

For Brazilian growers, the ultimate value of a crop depends on “who it is sold to” and “how much is sold.” Today, the answer to this question is becoming exceptionally clear. In 2024, China’s total soybean imports surpassed 105 million tons for the first time, of which 71.07% — 74.65 million tons — came from Brazil, an increase of 6.7% year-on-year. Entering 2025, the trend has become even more evident — in September alone, China imported 10.96 million tons of soybeans from Brazil, accounting for 85.2% of total monthly imports, while U.S. soybeans were completely absent from the market.

This surge in market share is not a short-term substitution but a clear signal of global supply chain restructuring. As the world’s largest soybean consumer, China has an annual demand of over 110 million tons, but a self-sufficiency rate of less than 20%, meaning stable import demand will persist long-term. More critically, Brazil has formed deep alignment with the Chinese market: from January to September 2025, 77% of Brazil’s 3.45 billion bushels of soybean exports were destined for China — behind this level of reliance is a mature logistics network and established trade trust.

Meanwhile, domestic market support is also robust. The Brazilian government’s “Future Fuel” program has increased the biodiesel blending ratio from B14 to B15, which will increase demand for soybean oil by 7%. By 2035, this ratio is planned to rise to over 25%. The dual demand from both domestic and international markets provides a “double guarantee” for the sale of Brazilian soybeans.

Second Account: Is the “cost-effectiveness” of Brazil Soybean high?

Faced with clear market demand, growers are more concerned about actual returns. Although global soybean prices have fallen to a four-year low since 2024 — with U.S. soybeans even dropping below planting costs — the situation in Brazil is different. Thanks to advantages in fixed costs and a drop in fertilizer prices driven by lower crude oil prices, official Brazilian estimates show that soybean farming still offers a net profit margin of $200–250 per hectare.

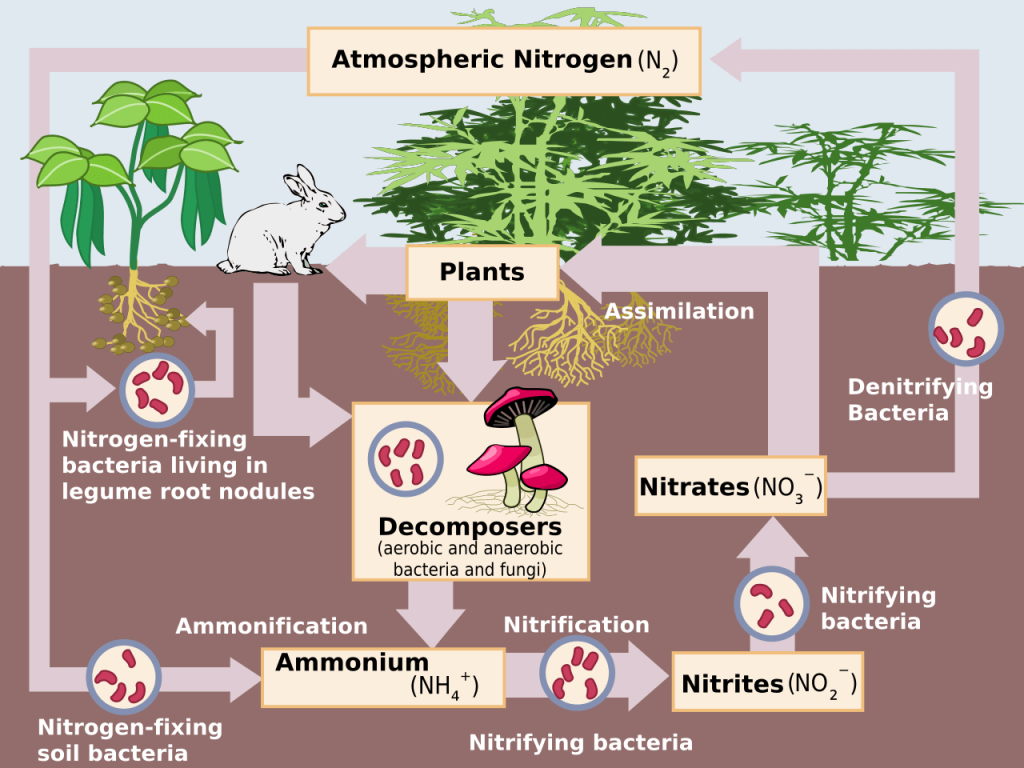

A comparison with other crops further highlights the advantages of soybeans. In the temperate regions of southern Brazil, corn farming is approaching loss levels, while soybeans can still deliver returns of around $200 per hectare. In tropical regions, soybean profitability far exceeds that of corn. Local farmers widely adopt the “soybean – second-season corn” planting model, using soybeans’ nitrogen fixation ability to reduce nitrogen fertilizer costs in corn farming and maximize profits. Projections from Brazil’s National Supply Company (Conab) also confirm the rationale behind this choice — in the 2025/26 crop season, soybean planting area is expected to increase by 3.5% to 121 million acres, while corn acreage growth is mainly driven by rotational demand after soybean harvesting.

Even considering a 4% increase in direct costs that narrows gross margins, soybeans remain the optimal choice for Brazilian farmers. Data from the Center for Advanced Studies on Applied Economics (Cepea) at the University of São Paulo shows that although the next season’s gross margin per acre of soybeans has dropped from $165 to $105, this is still significantly better than corn, whose gross margin is only $6 per acre.

Third Account: Brazil Soybean after Expansion, How Can “Production Efficiency” Be Ensured?

Once “growing more soybeans” becomes a consensus, a new question arises: how can the expected yield of 6.5 billion bushels be achieved on 121 million acres of land? The answer lies in the upgrading of agricultural mechanization.

Currently, soybean farming in Brazil is already facing efficiency bottlenecks — as of October 11, 2025, only 11% of soybean planting had been completed, lower than the five-year average of 17%. With the expansion of planting areas, the contradiction between labor shortages and complex terrain will become even more acute. Mato Grosso, in central-west Brazil, accounts for the core share of national soybean production. The region’s complex soil requires high-horsepower four-wheel-drive tractors, and the market penetration rate of such models has surpassed 65%, with purchases of models above 200 horsepower increasing by 23% year-on-year.

It’s not just the planting stage — mechanization is also urgently needed in harvesting and field management. Seventy percent of Brazil’s agricultural output comes from family farms. These small to medium-sized growers urgently need high-efficiency equipment adapted to small plots. Take crop protection, for example: traditional tractor spraying is not only inefficient but also poses a risk of excessive pesticide residues. Using drones instead can increase efficiency sixfold, with more uniform droplet coverage and a 40% reduction in residue. In addition, the high humidity of the Amazon region requires farm machinery with anti-rust coatings, while the semi-arid northeast needs low-pressure tire technology. These specific needs indicate that current equipment must be upgraded.

Final Choice: What Kind of Agricultural Machinery Can Match the Demand?

In the competitive Brazilian agricultural machinery market, cost-effectiveness and adaptability are becoming key decision factors. Sixty percent of farmers prioritize financing costs and equipment prices, and models that can adapt to local climate and terrain are more popular.

Against this backdrop, Chinese agricultural machinery products are gaining increasing attention. The core advantage of this equipment lies in its “precise adaptation”: to address the high humidity in the rainforest regions of Brazil, Weichai Lovol has developed tractors with anti-corrosion coatings, with a failure rate 40% lower than European and American models during the rainy season, earning them the nickname “Rainforest Warriors” among farmers; for small and medium farms, China YTO’s “Dongfanghong” combine harvester is priced at only half that of equivalent Western products, with sales in South America surpassing 20,000 units in 2024. At the agricultural fair in São Paulo state, Chinese drones equipped with AI obstacle avoidance and precision spraying systems gave local cooperatives a glimpse into the possibilities of digital farming.

Policy and supply chain support further validate this choice. The Brazilian government offers 8%-12% tax incentives for farm machinery that meets emission standards, while Chinese agricultural equipment manufacturers have generally launched Euro V-compliant models, with some even compatible with biofuels, reducing operating costs by 17%. More importantly, Chinese agricultural machinery has already captured over 50% of the South American market, and specialized service centers have appeared across Brazil, significantly improving spare parts availability and after-sales response speed.

For Brazilian soybean growers, the current market opportunity is crystal clear: Chinese demand offers a stable sales channel, soybean profitability justifies the planting choice, and mechanization is the necessary path to seize this opportunity. Among the many agricultural machinery options, those that balance cost and efficiency while matching local needs will ultimately become the winners in this soybean cultivation boom.Chinese farm machinery is redefining value in Brazil — efficient, durable, and built for local needs.

Seize the opportunity. Talk to us today to upgrade your operation.